Wondering why you could get a loan modification if you wouldn’t qualify for a refinance?

It’s a valid question. I mean, are they really all that different… In the grand scheme of things, no. But… the reason you are not able to qualify for a refinance is that the payments are not current, and your credit has taken a hit.

Usually, people refinance when interest rates go down. They don’t think about restarting their loan and the interest paid over the life of the loan. This is the same as a loan modification. But in a modification, they add the back payment to your loan balance. You don’t always get a lower interest rate.

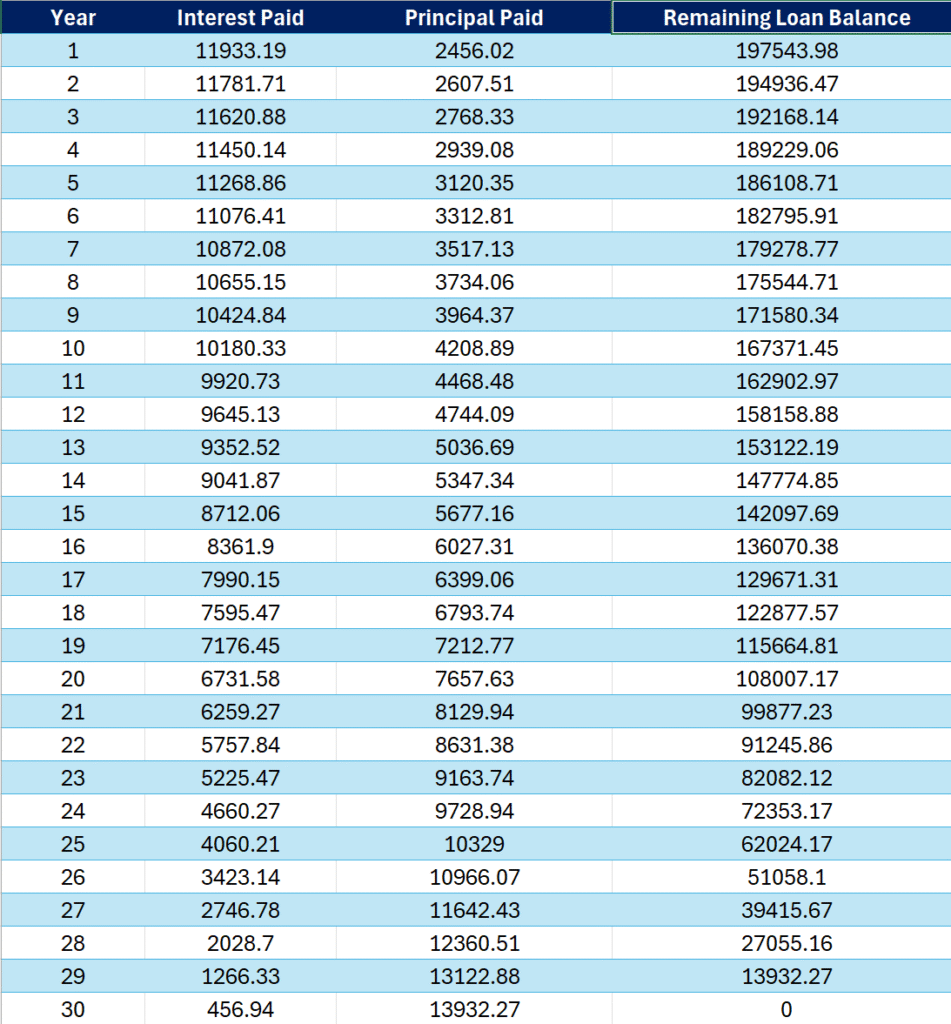

Most people don’t know that mortgages are amortized. This means interest is paid first. Look at your mortgage statement after buying a home. You’ll see the interest rate is much larger than the principal paydown amount. When you refinance or modify your loan, it’s like starting your mortgage over. You begin paying interest upfront again, no matter what year you were in.

Below is a chart so you can have a visual of the interest compared to the principal payments each year for the lifetime of a loan.

Food for thought when considering a refinance or loan modification.

Unfortunately, 20% of loan modifications get approved. But 2 out of 3 of those people will end up defaulting again. This time, it’s even worse. They don’t have as much equity in their loan, if any. Sometimes, people are underwater. They can’t sell the property without having to bring money to the closing table. No one wants to do that. We still have some options to save these second-time borrowers from foreclosure. But there are fewer options, and they are not as great.

If the owner had sold the property the first time, they would have been better off. They could have gotten some money from the property.

If you find this interesting or if you need assistance with an upcoming foreclosure, you can find more information or reach out to us here.